Mortgage calculator with large principal payment

However interest rates for ARMs change at regular intervals so both the total monthly payment due and the mix of principal and interest in a given payment can change considerably at each interest-rate reset. Total interest paid during term using IO payments.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Which can be used to pay off the mortgage.

. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and. 30-Year Fixed Mortgage Principal Loan Amount. We take your inputs for home price mortgage rate loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest.

Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs. Use our home value estimator to estimate the current value of your home. Decreases your interest rate.

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Mortgage calculator with extra payments can help you understand how you could save money and payoff your. Found on the Set Dates or XPmts tab.

Principal that they are obligated to pay back in the future. Mortgage calculator - calculate payments see amortization and compare loans. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Principal is the borrowed amount.

Though paying a 20 down payment may not be required its still worth making a large down payment on your mortgage. Mortgage Amount or current balance. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Those clients may want to explore the interest-only mortgage calculator. Four alternatives to paying extra mortgage principal. Early on in the loans term a relatively large share of the payment is applied toward interest then as the borrower pays down the loan an increasing share of the payment goes toward interest.

Total amount repaid for interest only with balloon payment for original amount borrowed at end of the loans term. Each month a payment is made from buyer to lender. LTV ratio measures the value of your loan.

Principal interest taxes and insurance. Pay off your loan sooner or access cash for a large purchase. Make Lump Sum Loan Payments.

Pay this Extra Amount. Recurring extra payments add up to reduce your principal balance. Whats included in a mortgage payment.

In the US the Federal government created several programs or government sponsored. Payment Amount Interest Paid Principal Paid Principal Remaining. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

PrincipalThis is the total amount of money you borrow from a lender. When you make a 20 down the large payment reduces your loan-to-value ratio LTV. Consider how long you plan on living in the home.

Mortgage Closing Date - also called the loan origination date or start date. You can also use the calculator on top to estimate extra payments you make once a year. Specialized financing for large-scale beef producers to stay competitive and manage improve or enlarge their operations.

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. Total principal interest. To estimate how much time and interest you can save use our extra mortgage payment calculator.

In a year you might receive lump sum payments in the form of. Interest only payments would be. Interest-only loans can also be good for people who have a rising income significant cash savings and a high FICO score.

Here are several benefits to paying 20 down on your home loan. But if you have large funds you can use it to decrease a considerable portion of your loan. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals.

The Payment Calculator can help sort out the fine details of such considerations. This calculator determines how much your monthly payment will be for your mortgage. Full purchase cost including down payment etc.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Principal interest taxes and insurance are the building blocks of a mortgage payment and a few of the common mortgage terms youll find on the homebuying journey. Estimating your monthly payment with our mortgage calculator or looking to prequalify.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. For Adjustable Rate Mortgages ARMs amortization works the same as the loans total term usually 30 years is known at the outset. A portion of the monthly payment is called the principal which is the original amount borrowed.

Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. It can also be used. Usually 15 or 30 years in the US.

First Payment Due - due date for the first payment. Interest is what the lender charges for borrowing money and varies depending on the market and candidate. You can also see the savings from prepaying your mortgage using 3 different methods.

360 original 30-year term Interest Rate Annual. Please use our calculator if youd like to get an idea of your estimated payments. Most people need a mortgage to finance a home purchase.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. A mortgage payment typically consists of four components often referred to as PITI.

Mortgage Calculator Estimate Your Monthly Payments

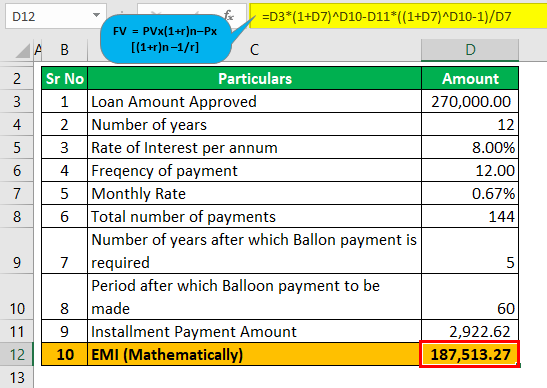

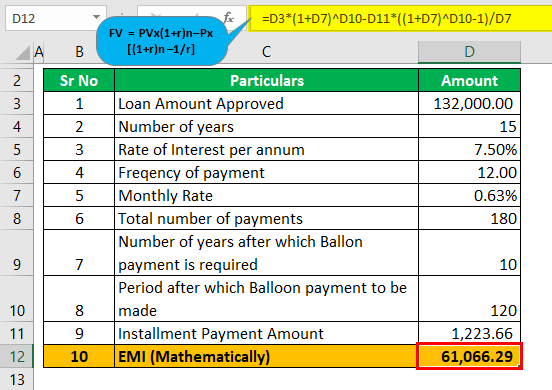

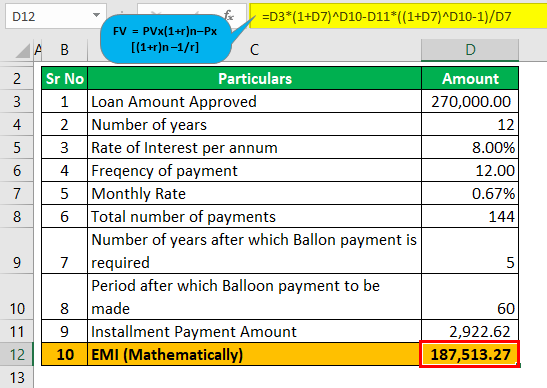

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage Recast Calculator To Calculate Reduced Payment Savings

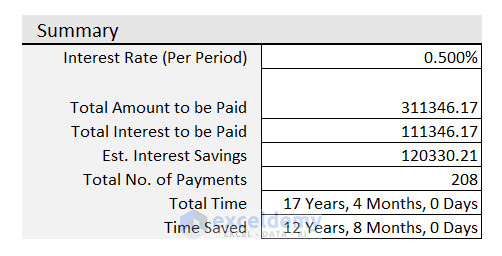

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Extra Payment Mortgage Calculator For Excel

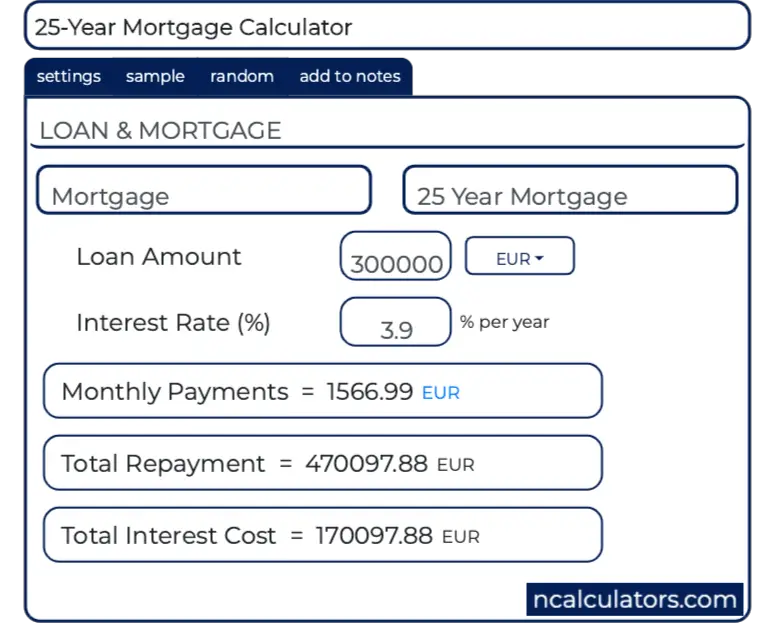

25 Year Mortgage Calculator

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Best 10 Mortgage Calculator Apps Last Updated September 16 2022

Mortgage Calculator With Down Payment Dates And Points

Amortization Chart Template Create A Simple Amortization Chart